1040 Schedule A 2024 Single – The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for . The 2024 tax season has already begun. Claiming the standard deduction instead of your actual deductions is much easier, but it might cost you more. .

1040 Schedule A 2024 Single

Source : www.investopedia.com2023 2024 Tax Brackets and Federal Income Tax Rates | Bankrate

Source : www.bankrate.comAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.comIRS moves forward with free e filing system in pilot program to

Source : www.sandiegouniontribune.comIRS Announces 2024 Tax Season Start Date, Filing Deadline | Money

Source : money.com2024 Tax Refund Schedule: When will you get your payments during

Source : www.marca.comForm 1040: U.S. Individual Tax Return Definition, Types, and Use

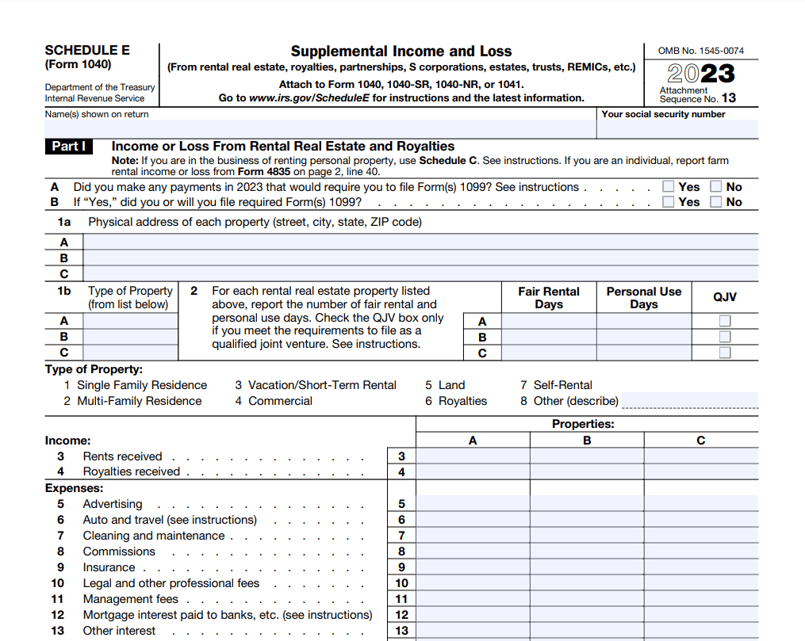

Source : www.investopedia.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.comConnecticut tax cuts affect over 1 million people in 2024

Source : www.fox5ny.com2024 presidential candidates’ tax proposals: Here’s what we know

Source : www.cnn.com1040 Schedule A 2024 Single Form 1040: U.S. Individual Tax Return Definition, Types, and Use: Every dollar you win from gambling should be reported to the IRS, otherwise you could be fined or even go to jail. . For 2023, the standard deduction is $13,850 for married filing separately and single (early 2024). A copy of this form will also be sent to the IRS. In most cases, homeowners can report the amount .

]]>:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)

:max_bytes(150000):strip_icc()/1040.asp-final-8113a173a9ce4bf699ffe7e1a5b47156.png)